PV

Name

Present value

Description

Returns the present value of an investment based on the interest rate, number and amount of periodic payments, and future value. The present value is the total amount that a series of future payments is worth now.

Syntax

PV(Rate, Nper, Pmt, Fv, Type)

Remarks

Arguments are as follows:

| Argument | Description | |

|---|---|---|

| Rate | Interest rate expressed as percentage (per period) | |

| Nper | Total number of payment periods | |

| Pmt | Payment made each period; cannot change over the life of the annuity | |

| Fv | (Optional) Future value If omitted, it is assumed that the calculation is based on the payments. |

|

| Type | (Optional) Indicates when payments are due If omitted, it is assumed that the payments are made at the end of the period. |

|

| Set Type equal to | If payments are due | |

| 0 | At the end of the period | |

| 1 | At the beginning of the period | |

| Note: You must specify a value for the Fv argument if you are going to specify a value for the Type argument. |

Use consistent units for specifying the Rate and Nper arguments. If you make monthly payments on a five-year loan at 8 percent annual interest, use 0.08/12 for the Rate argument and 5*12 for the Nper argument. If you make annual payments on the same loan, use 0.08 for Rate and 5 for Nper.

For all the arguments, money paid out such as deposits in an investment, is represented by negative numbers; money you receive, such as dividend checks, is represented by positive numbers.

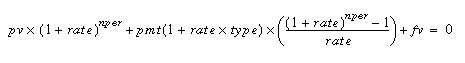

For all the financial functions (FV, NPER, PMT, and PV), the spreadsheet uses the following formula and solves for the required variable:

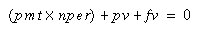

If rate is 0, then:

Data Type

Accepts numeric data for all arguments. Returns numeric data. For more information, see Data Type for Each Cell Type.

Example

PV(R1C1/12,48,R1C2,0,0)

PV(0.005,60,-100,0,1)=5198.4188554887